Rs 3 Lakh Crore up for Grabs. Finance Minister, Stop Lip Service, Act Fast

BeyondHeadlines Special Correspondent

Scene 1: Mohammad Junaid passed away last December, leaving behind a hapless family of five. While travelling from Patna to Darbhanga, a road accident cut short his life at a time when he had many dreams to fulfill. With the death of the only breadwinner, the family sees no hope at the end of the tunnel. Junaid, a 45-year-old carpenter, had not much to offer barring a life insurance that can fetch about Rs 5 lakh -a huge relief at the hour of crisis. But the family remains oblivious of the policy till date. The death benefit of Junaid goes to ‘unclaimed’ kitty of the insurance company instead of the family.

Scene 2: What if one holds loads of shares, but finds those of ‘worthless’? A senior citizen from Delhi Ashok Jain was a dejected man for being failed to transfer shares and debentures to his name even after running pillar to post. The investments remained on paper with no tangible value.

The instances are not fictitious. In fact, Mohammad and Jain are tip of the iceberg considering that a mind-boggling Rs 3 lakh crore is lying in the system with nobody to claim it. Indian banks, insurance companies, post offices, provident funds, share markets and mutual funds are flooded with unclaimed investments. This essentially means lakhs, may be even crores, of investors may have simply forgotten the investments or do not know about the money they have inherited. No wonder, many goldmines in our backyards are just waiting to be discovered!

The magnitude of the unclaimed investments is hard to ignore any more. “This is such an issue that afflicts every household without noticeable hullabaloo. We prefer to ignore it despite chronic presence in our daily life”, says Abhay Chandalia (Jain), a Chartered Accountant and co-founder of New Delhi-based ‘Share Samadhan’, a specialized firm in the area of unclaimed investments credited with unlocking investors’ locked money.

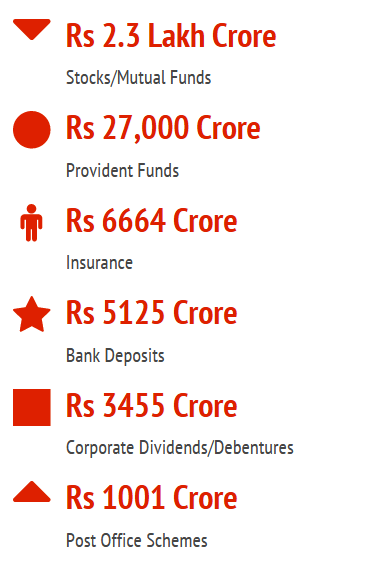

Shares and mutual funds claim the lion’s share of unclaimed money. It is unofficially estimated at Rs 2.3 lakh crore. Vikash Jain, co-founder of Share Samadhan elaborates: “The nature of unclaimed investments varies in capital markets. It is mostly stuck in physical shares. However, exact amount is hard to calculate. We can work on broad calculations going by some unofficial data. For example, a newspaper last year roughly pegged it at Rs 2.3 lakh crore as it found about 21 billion shares are still in physical form.”

It, however, holds no ambiguity beyond capital markets, the amount is no less mind-boggling. A whopping Rs 60,000 crore in crucial instruments of dormant bank accounts, inoperative provident funds, post office savings schemes and matured insurance policies are waiting to be taken back by the rightful owners. Of this, provident fund alone has Rs 27,000 crore of unclaimed treasure. “An unclaimed amount of Rs. 27,000 crore is lying with the Employees Provident Fund Organisation as the identity of the subscribers could not be established”, says the Union Labour Minister Bandaru Dattareya in a recent function at ASSOCHAM. Many provident funds account holders neither withdraw nor transfer their PF accounts with a change of job.

Insurance sector, both life and general insurance companies, is also grappling with unclaimed investments of Rs 6664 crore which were not encashed by policyholders or their nominees. Like Junaid, it is quite common in India that insurance policies are not claimed by the family in case of the death of policyholders. LIC alone has some 1.8 lakh policies for which the maturity benefits have not been claimed.

More than Rs 5,125 crore is languishing in dormant accounts and unclaimed bank deposits across India. Popular schemes such as Indira Vikas Patra, National Savings Certificates besides the regular savings pools are the main sources of unclaimed investments in post offices. The Minister of Communications and IT Ravi Shankar Prasad says: “Rs 1,000.61 crore has been lying unclaimed in post office savings bank, which includes Rs 894.59 crore for Indira Vikas Patra, Rs 60.02 crore for 5 years National Savings certificate, Rs 24.20 crore for fixed deposit. The main reason for unclaimed amount is non-withdrawal of money by depositors after maturity of their investment in small savings schemes discontinued long back.”

Unlocking of the unclaimed investments is a win-win situation of all of us. Vikash, a Chartered Accountant by profession opines: “Imagine, what would happen if the entire amount is unlocked? It can make a deficit-ridden government richer manifold, besides relief to individuals. It may help the government to earn huge tax and also increase fund flow to infrastructure, defence, health and education”.

As the benefits are hard to ignore, so are the problems. Most crucially, it’s mounting with every passing day, giving the policymakers real headache.