KCR’s Golden Boy KTR Woos Lulu Group to Invest Rs 500 Crore in Golden Telangana!

The Charismatic Chief Minister of Telangana K Chandrasekhar Rao has a Golden…

There Are Enough Laws to Tackle Black Money; Parliament Cannot Take Dictation From Self-Appointed Crusaders: Union Commerce and Industry Minister

BeyondHeadlines News Desk New Delhi: Making an attempt to rescue the government…

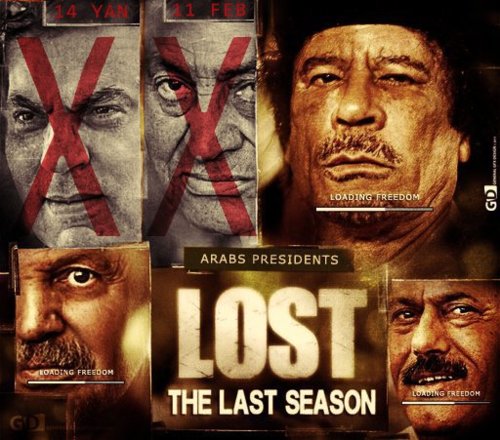

Switzerland: Govt Freezes $1bn Worth of Gaddafi, Mubarak and Ben Ali Assets

The Swiss government has ordered banks and other financial institutions to freeze…