The issue of non-performing assets aka bad loans in the country’s banking sector has become a hot topic of debate and discussion for quite some time now. It is believed that the problem of staggering NPAs has reached to such a level that if appropriate medicine not injected into the banking system immediately, the health of the economy of the country would collapse anytime soon. The tumultuous financial uncertainty unleashed after demonetization and several bank frauds are severely hurting the broader economy of the country. The icing on the cake is dwindling rupee from 44.00 against US dollar in August 2011 to 70.90 on Nov. 2018.

Though, the government is believed to be aware of the situation and trying their best to bring the system back to life. But the bigger question that left many experts sceptical is, would the government be able to contain the ailing economy or let it boil over that too when barely four months left to go for the Lok Sabha election.

How serious the NPAs issue is?

Is the NPAs issue so serious that we should all be worried about? The straightforward answer is, yes. The country’s central banking agency and monetary policies regulator, the RBI in its bi-annual Financial Stability Report released in June last year had red flagged that with staggering bad loans and rising bank scandals, the banking sector is under tremendous stress which could drag down economy of the country.

The seriousness of the issue can be gauged by the fact that over Rs 10.2 lakh Cr worth of loans – GDP of at least 137 countries – till March quarter 2018 classified as Non-Performing Assets. This figure accounts for just 10% of all loans given in the country. This means, neither the interest on the loan nor the principal amount paid back to banks as a result, banks suffered a huge loss of capital. Around 80% of these loans which turned out to be NPAs were credited to the select corporate and industries by the State-owned public sector banks.

The loan defaulters feel immune to any culpability as corporate-political nexus, lack of adequate bankruptcy code and rusty legal system make difficult for banks to recover these loans. One such fine example is when the grounded Kingfisher Airlines was already marred in a financial crisis, the SBI credited loan to the tune of Rs 900 Cr to now fugitive Vijaya Mallay. These defaulters enjoy strong influence over any policy-making decision that even the banks have no rights to make their names public.

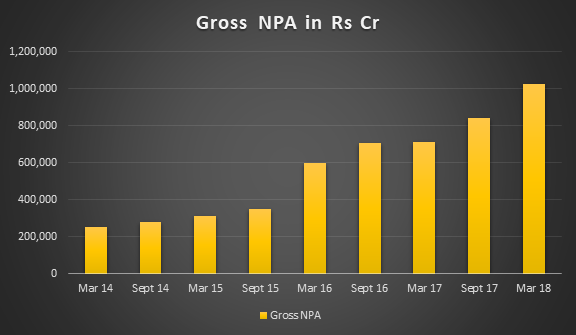

In March 2014, when the UPA was ousted from the power at the centre, the NPAs was standing at Rs 2.51 lakh Cr. Now after four years, the figure multiplied to as many times to reach astounding Rs 10.26 lakh Cr at the end of March 2018.

With the ever-rising NPAs, banks are feeling stressed because of almost no profit margins to fund other projects. This is resulting in not only unemployment but also affecting the country’s economy negatively. The bad financial health of public sector banks means a bad return for shareholders. In such a scenario, even the investors would hold on investing until the situation improves.

The financial health of banks:

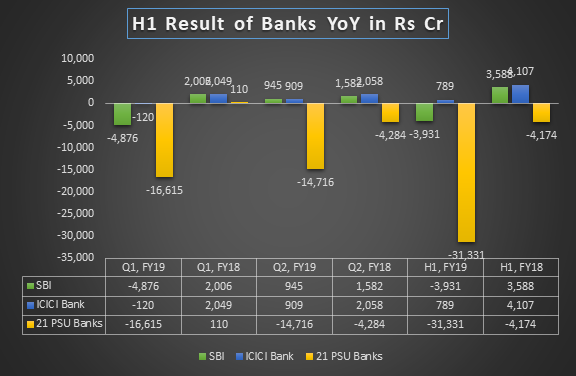

The Indian banking sector is probably passing through its worst phase ever. Of the top 10 public-private sector banks, a majority of the lenders are in the red territory and in deep trouble. The country’s largest public sector lender the State Bank of India reported a net loss of Rs 4,875.85 Cr in the first quarter ended June 30 as against Rs 2,006 Cr net profit in the corresponding period of 2017-18 fiscal. This is the third straight quarterly loss of the bank. However, in the second quarter ended September 30, the lender reported a net profit of Rs 945 Cr, but still nearly 40.27 % less of net profit of Rs 1,582 Cr reported in the same period of previous fiscal.

The bank incurred a net loss of Rs 3,930.85 Cr in the first half of this fiscal as against Rs 3,588 net profit in the same period last year. The SBI’s net loss in 2017-18 stood at Rs 6,547.45 Cr as against a net profit of Rs 10,484.1 Cr in previous fiscal.

The country’s largest private sector lender, the ICICI Bank too reported its first-ever net loss of Rs 119.55 Cr in the quarter ended June 30 as against a whopping Rs 2,049 net profit for the same period of previous fiscal. However, the bank recovered slightly in the second quarter with a net profit of Rs 909 Cr but fell far behind of a net profit of Rs 2,058 Cr in the same quarter of previous fiscal.

In the first half of fiscal 2018-19, the lender reported a loss of 80.78% in its net profit at Rs 789.45 Cr as compared to Rs 4,107 Cr in the same period of previous fiscal.

The great financial distress:

At present, India has 21 public sector banks with more than 50% stakes held by the government in each bank. However, after the merger of Vijaya Bank and Dena Bank with Bank of Baroda – for which board of all three banks approved and sent the recommendation to the government for approval – the number of nationalized banks will come down to 19.

Due to rising bad loans, the cumulative net losses of 21 State-owned public sector banks reported at staggering Rs 16,614.9 Cr in the quarter ended June 30 as compared to nearly Rs 110 Cr net profit in the same period of 2016-17 fiscal. The net loss further widens by nearly 350% to Rs 14,716.2 Cr in the second quarter ended September 30 as against Rs 4,284.45 Cr net loss incurred in the same period of previous fiscal.

The cumulative loss of these PSU banks in the fiscal 2017-18 reported being at whopping Rs 87,370 Cr. The loss would have been much more had the two banks namely Indian Bank and Vijay Bank not posted a net profit of Rs 1,259 Cr and Rs 727 Cr respectively during the said fiscal. In fiscal 2016-17, these banks had together posted a net profit of Rs 473.72 Cr.

Will this affect the common man?

Experts have already warned that the whopping NPA will have far-reaching ramification on Indian economy in the months to come, yet neither the banks nor the government will bear the brunt. It is taxpayers who will pay the price. With most of the banks facing severe cash crunch now, they have resorted to reprehensive measures to bring the system back to life.

One among many such measures is a penalty on non-maintenance of monthly average balance (MAB). The SBI alone has collected Rs 1,772 Cr in the form of minimum balance penalty from customers for non-maintenance of MAB for the April-Nov period of 2017. Imagine, who are these people who were forced to pay the penalty? Obviously, those who are at the bottom of financial strata. The banks seem to have indulged in unethical practice and going against their vision statements. At one hand, they dished out thousands of crores of rupees to corporate honchos without doing due diligence, on the other, they robbed the poor who can’t afford to maintain MAB in their accounts. However, after a lot of criticism, the SBI cut down the MAB to Rs 3,000 from Rs 5,000 in metro cities. In urban areas, it’s now Rs 3,000, while for semi-urban and rural areas, it is Rs 2,000 and Rs 1,000, respectively.

Not only that, debit card annual fee, ATM usage, email and SMS alerts, money transfer charges, bank statement attestation, reset password or PIN number and closing bank account are their other nefarious measures through which banks are charging their customers.

So, next time when you do any banking transaction be ready to pay the price for the crime you didn’t commit!