Saiam Hasan for BeyondHeadlines

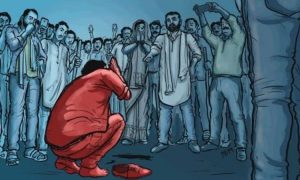

As victims of Uttarakhand floods are still trembling with fear about their future, struggling hard to recover from ills of the devastation and fighting for survival in odd conditions, banks chase them to repay loans. After talking with victims in Uttarakhand, Saiam Hasan observes: Banks are trying to make money by compounding interest, as they have to do business after all. I’m appalled!

Editor: It’s the government’s duty to take immediate notice of it and check for any irregularities, and engage in rehabilitation work through its various departments and agencies.

Trilok Sing, a resident of a Lotli village of Tharali, used to work in a hotel in Gaurikund which was wiped out by cloud burst on 16th June 2013. He lives with 6 other members in his family including aged father who is perpetually ill. Now his father’s pension (Rs. 8000/month) is the only source of income for 7 people out of which 2000 is going in repayment of agriculture loan and 3000 in medical loan.

Father’s medicines cost them additional Rs. 500-1000 (nearest descent hospital is in Dehradoon, reaching there takes Rs.400-500 per trip!). The family is living on a meager amount of Rs.2000/month and they do not know when they will get their livelihood to make both ends meet. Trilok is working under MNREGA – the only source of employment in his village these days. He has just 15 days of employment as against 100 days guaranteed in the Act. There are too many men who need it and work/ money is limited.

Father’s medicines cost them additional Rs. 500-1000 (nearest descent hospital is in Dehradoon, reaching there takes Rs.400-500 per trip!). The family is living on a meager amount of Rs.2000/month and they do not know when they will get their livelihood to make both ends meet. Trilok is working under MNREGA – the only source of employment in his village these days. He has just 15 days of employment as against 100 days guaranteed in the Act. There are too many men who need it and work/ money is limited.

Their house has been damaged and they have tripal on one side of the house because they have not been given money to repair their house (as was guaranteed by the government). The Patawari (Revenue Officer) came to inspect the house two months ago assuring support from the government but nothing has come to them.

Yes, the loan has been suspended (although none of the banks- PNB, SBI and cooperative banks that operate in the block have informed people about loan suspension) but when I told him that the interest on loan for this year is going to be calculated and people will be expected to pay it next year (which will compound into greater amount), the man said in a feeble voice, “how will we pay it next year- we don’t know when we will have money in our hand next”. His voice dipped as he said it ‘I would rather pay installments this year’.

Many people’s loan installments are being deducted by bank from the compensation that government has given for loss of house and life.

Yashoda Devi from the same village is paying 1500, a meager amount for a middle class family but not for a family that doesn’t earn anything and doesn’t know when they will have money in their hand. She has a loan of 30,000 from Co-operative Bank.

Surendar Singh has a loan of 50000 from SBI and has paid 2000 for 2 months. Unfortunately, he does not have Rs. 2000 now to pay to bank but the bank has been asking him to pay.

Devendra Singh has an agriculture loan of Rs.30,000 from SBI, Talwadi branch- his fields have been washed away.

Mr. Gosai, broke down on phone crying for help, he has been unable to pay home loans in last 4 months, his house is in shatters. He tells me the entire belt from Village Lodsi to Khulsari (10 kms) has the same plight. There is a feeling of helplessness in the valley. They are perishing and the only way left for him is to take more loan but he will not get any. He pleads me on phone to get him another loan to survive.

Surendra Singh Rawat has a loan of 1 lakh from Uttaranchal Gramin Bank, he has been unable to pay installments in 4 months since the tragedy that took away everything that they had. Poor man doesn’t even know that interest on his loan is getting compounded and there is a worse tragedy approaching him.

J. S. Kunwar, Manager of Punjab National Bank, Pharali branch, told me that ‘Since there is no notice from government to forgo the loan, they have to pay. But for the people whose plight is worse, time to repay has been extended for two years, but the loan will be still there and with the interest.”

Banks are trying to make money by compounding interest, as they have to do business after all. I’m appalled! Yes, this is happening when there is a flood of money coming into Uttaranchal for relief and rehabilitation. How can we let this happen??

Welfare is the duty of the government- it exists to facilitate people’s life and growth. These people just want survival- are they demanding too much??